After only two years, Stankiewicz

leaves Pawtucket Finance Director position

By Will Collette

|

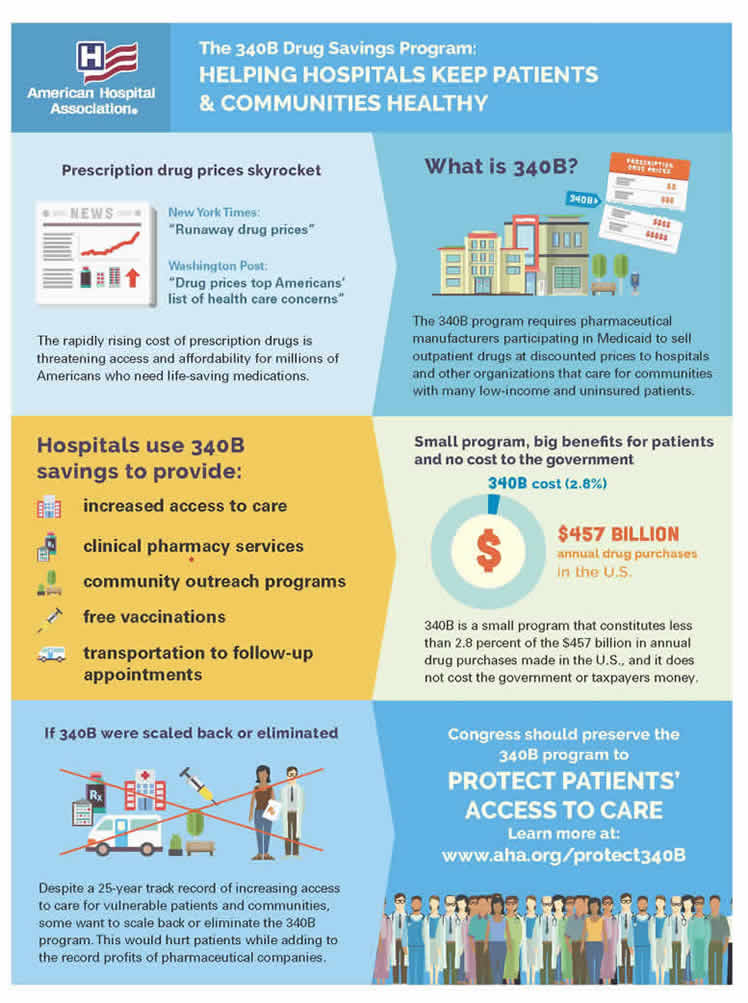

He manned the ramparts at Town Hall,

fending off all non-CCA interlopers |

Remember Stanky? For 10 years, Mark Stankiewicz did the

ruling Charlestown Citizens Alliance's bidding. He insured a place for himself

in the CCA Hall of Fame by being a Town Administrator who actually told me that

he “works for the CCA” and not the citizens of Charlestown.

Ex Town Administrator Stankiewicz served the CCA by covering

up shady

land deals, denying access

to public records and rationalizing

financial screw-ups such as the CCA’s infamous “$3 million Oopsie” where $3 million in

Charlestown funds were, to use Stanky’s term “misallocated” for two

years. The CCA is STILL talking about what a great job he did.

Under Stankiewicz, Charlestown

racked up the state’s highest per capita administrative costs - $566 per capita. Compare

that to Cumberland, the lowest at $106 or to our neighbors in South Kingstown ($175),

Richmond ($199), Hopkinton ($234) or Westerly ($270). But to the CCA, he was worth

every penny.

He left Charlestown February 2023 after the 2022 election that saw

voters overturn the CCA's decade of control over the Town Council.

CCA spokes-troll Bonnita Van Slyke claimed Charlestown Residents United (CRU),

winners of the 2022 and 2024 town elections, ousted Stankiewicz and denied there were ever any problems. The CCA

Steering Committee stridently asserted: “Do not be fooled! This is a

FORCED, not a voluntary, resignation. Mark has served the town masterfully for ten years and has no desire to leave.”

But the fools turned out to be the CCA because Stankiewicz

had already lined up a new job to become Town Administrator in Berkley Massachusetts

even before the first vote in November 2022 was counted. Clearly, the CCA was clueless about his secret plan and looked pretty stupid.

Stankiewicz played the

game out to its end, squeezing more money out of the citizens of Charlestown by

timing his departure to coincide with his February 13, 2023 first day at his new job.

He only lasted

six weeks in Berkley. In his resignation letter, Stanky told the town "It's

because I got a fine job offer, and after careful consideration, I am taking it.

I was approached with this job offer. Another municipal position. I wasn't

searching for another job. I wasn't looking. If not for this job offer, I'd

still be here."

That “fine job offer” was a gig as Pawtucket Finance

Director.

Confidential sources in Pawtucket city government told me

Stanky’s 2023 appointment was made by Pawtucket Mayor Donald Grebien over the

objections of top city officials. Shortly after taking the job, Stankiewicz

told subordinates that he "isn't a finance guy" clearly

indicating that he didn’t think he was qualified for the job he was holding. His

record in Charlestown certainly supports that admission.

Stankiewicz brought Irina Gorman, Charlestown’s ex-treasurer

who was directly involved in the $3 million “oopsie,” with him and she became

Pawtucket Treasurer.

Upped the Mayor’s salary by almost double

One of Stankiewicz’s first major projects was to engineer a huge

pay increase for his patron, Mayor Grebien – raising the Mayor’s base

salary from $80,000 to $150,000. No doubt Grabien appreciated the value of such an unquestioning soldier as Stanky.

Mistakes led to big money trouble for Pawtucket Schools

An on-going problem that was apparently due to Stankiewicz’s

inattention was last year’s revelations that money had run out to continue

construction of two new schools. Pawtucket voters had approved $570

million in borrowing.

Here’s

how the Providence Journal described what happened:

The

situation became obvious in mid-March when city Finance Director Mark

Stankiewicz alerted public schools Superintendent Patricia Royal in a memo that money for key

payments was running out. Stankiewicz warned in the memo that without

additional funds for ongoing projects, come April 15, "we will no longer

be able to make substantial contractor payments in order to reserve sufficient

funds for normal operating expenses, including payroll."

Stankiewicz said records show that of the $220

million approved, just $30 million in bonds were issued last May. In the

meantime, roughly $50 million has been spent on the school projects. From the

state, $40 million has been paid out for the projects, and Stankiewicz said in

his mid-March memo that there's no money left, and there were no requests for

further funding from the Rhode Island Health and Educational Building

Corporation, the "quasi-public" agency that helps health care and

educational institutions access financing for construction and renovation

projects.

This looks remarkably like how Stanky handled Charlestown’s $3

million “Oopsie.”

While it’s a good thing that Stankiewicz brought this issue

to the School Superintendent’s attention, the crucial mistakes that led to this financial

crisis happened on his watch during the ten months after he became Finance Director.

Here’s how the Pawtucket

City Council President described it:

[City Council President Terrence] Mercer said it was

his sense the problem is "a whole host of things that don't seem to be getting done,"

including crucially important reimbursement requests that need to be sent to

the state's education department if the city is to get more money for its

projects.

Part

of the issue, Mercer suspects, is some recent turnover in the finance

department, which caused the city to lose institutional knowledge.

Council President Mercer is talking about Stankiewicz. As Finance Director, it was his job to not only make sure city bills got paid but also that city collected the reimbursements that it was due. He does not get any points for finally warning the School Superintendent that the money had run out when he should have attended to it from Day One.

It's deja vu all over again and a much bigger screw-up than the CCA's $3 million oopsie.

This will cost every Rhode Island household at least $302

Stankiewicz has also been a major player in the

controversial minor league soccer stadium being built in Pawtucket. It’s first

home game was just held ending in a zero-zero tie.

The stadium is receiving a massive amount of corporate

welfare from city and state funds. Rhode Island taxpayers are on the hook for

$132 million in bond payments. When the bonds are paid off on this nice stadium, neither the state nor the city will have any ownership stake in the venue. According

to GoLocal, that will cost the average Rhode Island household $302 each.

The project ended up 50% over budget and years late. The City of

Pawtucket’s lead financial advisors resigned after concerns about the long-term

financial future of the stadium were unheeded.

In a letter

to the City, three executives of Hilltop Securities wrote:

“As you know we have detailed concerns about the

proposed stadium transaction and bond offering. As a fiduciary to the City of

Pawtucket and its development agency…we must do what we believe is in the

City’s and PRA’s best interest…Therefore, please let this serve as Hilltop’s

notice to the city and the PRA of our withdrawal as municipal advisor on this

bond offering”

The letter was dated August 16, 2023, a couple of months

after Stankiewicz took over as Pawtucket Finance Director. Despite this protest

resignation, Stankiewicz soldiered on with this project while cancelling

numerous other city projects – and neglecting to pay attention to the city schools

finances.

So what? Why should Charlestown voters care?

The life and times of Mark Stankiewicz continue to be

relevant to Charlestown residents and not just because every Rhode Island

household is on the hook for $302 to pay for the Pawtucket soccer stadium.

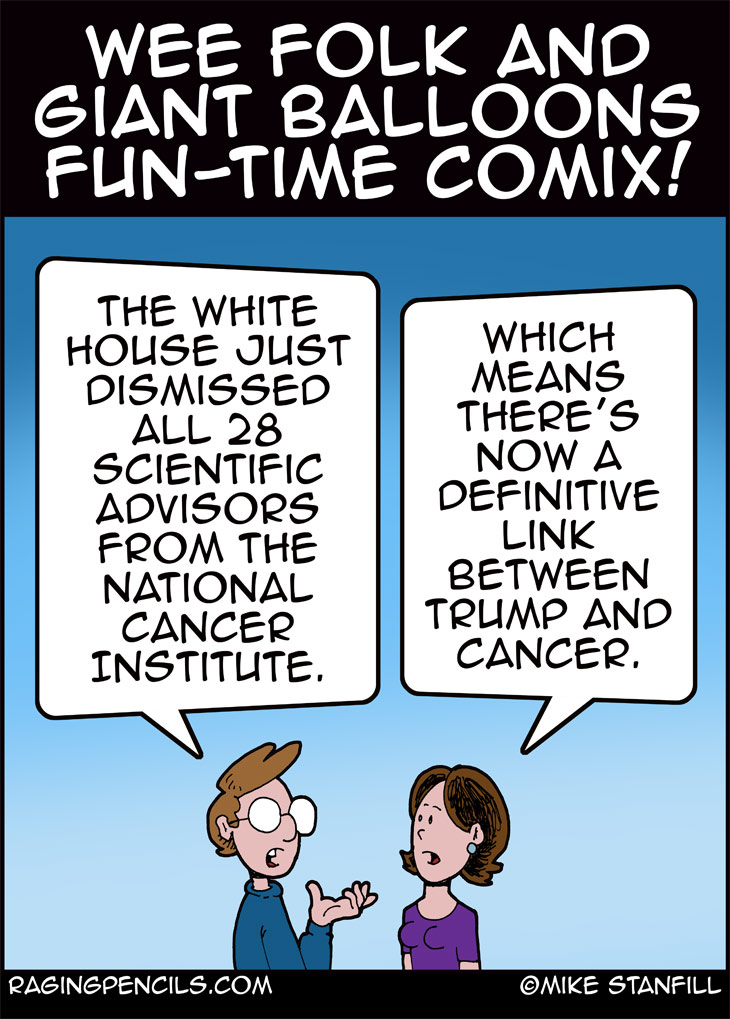

The CCA’s determined deification of Stankiewicz speaks to

the CCA’s lack of judgment on financial and governance matters, something

voters need to remember. As recently

as last July, the CCA is still defending Stankiewicz and denying that the

thoroughly documented financial screw-ups ever happened.

You can bet that if the CCA somehow regains control over the

Charlestown Town Council, they’ll be looking to replace our steady, drama-free

Town Administrator Jeff Allen with some toady like Stanky. We don’t need to

go backwards.

If you are interested in applying for Stankiewicz’s

Pawtucket job, the city wants to hire ASAP.

Here is the job posting:

.webp)